Streamlining your Global Benefits: An interview with Chris Bruce, Managing Director of Thomsons Online Benefits

GBV once again gains exclusive access to Chris Bruce of Thomsons Online Benefits for an insight into the global benefits market from one of the largest benefits software providers in the world

Global Benefits Vision: What are Thomsons Online Benefits’ core businesses and main activities in general, and how do they specifically relate to the global employee-benefits industry, today?

Chris Bruce: Thomsons are a unique, and within in the marketplace, a very exciting and interesting company and proposition in that we have, over the last 15 years, developed a global software solution, called Darwin, a single cloud based technology that provides global organi- zations one interface and software to manage their benefits around the world. This enables them to automate all administrative tasks and provide an incomparable experience to employees ranging from enrolment to work- flows. Moreover, it provides detailed insight to decision makers, allowing them to see what’s happening to their benefits on a global, regional and in-country levels.

GBV: Could you describe what benefits this covers, for example, does it include fringe benefits?

CB: Yes, very much so. We don’t actually manage the benefits ourselves e.g. we are not a pensions administrator or a TPA. What we actually do is manage (through our software) anything that is defined as a benefit.

For example, the enrolment of an employee into their retirement plan: where we calculate employee/employer contributions and enable the employee to select how much they would like to pay in. Another example might be a medical insurance scheme, where the employee gets single cover and can then add their family with the option for it to be either employee funded or co-funded by the employer.

A third, and more extreme example, is a client who manages their employee car parking within a country using our software where certain employees get free car parking based on their level within the organization (and this demonstrates how flexible and bespoke we can be). Our software catches their car number plate, informs the facility where they are parking whether they are entitled to free parking; and, if the employee doesn’t have a funded car parking benefit, then automated deductions are made to their payroll based on their usage. Thus we handle anything that can be perceived to be a benefit from an organization to its employees.

Furthermore, within Asia for example, a lot of benefits are managed through spending accounts. Thomsons has a solution to manage those spending accounts, so that any organization can manage them globally and process reimbursements through the same software. The bespoke nature of Darwin means that if a company has a gym membership benefit, for example, the employee can go to the gym, photograph their receipt and upload it into the app and it gets approved, or educational reimbursements, money spent on courses which can also be reimbursed through the software.

Thus, a client will license Darwin on a global level, and then decide which modules to utilize for different countries.

GBV: How did you, personally, become interested in global compensation & benefit and can you recall for us some of the history of Thomsons Online Benefits, when it started and a little about its first years?

CB: After university, I joined my family business, where my father was a corporate adviser; shortly afterwards this was sold to Alexander Forbes so I fell into this business, as many people do.

As a benefits consultant, and at the height of the dot com market, my colleagues and I discussed how the Internet would change the benefits market, especially how benefits were administered and communicated.

This led to the creation of our company in December 2000, Thomsons Online Benefits, which initially only focused on the U.K. market and until 2002 we were about 8 employees. At that time, we were approached by a corporate who told us they would only work with us if we were to deliver our service globally. Being a young, hungry “start-up” at the time led us to help the client design a global benefits scheme, and design our software to be able to deliver that scheme. The project was launched six months later and it was my belief then, as it is now, that one day all employee benefits would be managed in this way.

Thus, from 2003 we looked to develop our software globally and 2007 we won RBS (at the time the world’s biggest bank) as a global client, a significant milestone for us; in 2010 we won Google as a global client. and since then I believe we are the global benefits software provider for almost all of the well-known technology companies worldwide.

I still passionately believe this is a market that is hugely overlooked, and companies still spend a vast amount on administering global benefits with little value or understanding of how effective their global benefits plan is. Thus, it’s a mission for us to help companies administer their benefits, and also for us to help employees understand their benefits better by connecting them to their lives on a day to day basis to see the difference they make.

GBV: Do you envision Thomsons Online Benefits expanding into other core businesses at some point?

CB: We are incredibly focused on what we do and we are going through huge growth as an organization; we also see that more global organizations and larger companies in regional and other markets are choosing to adopt global benefits management and employee engagement software. And whilst we are, 15 years later, a company with 500 employees, I still believe we are a start-up at the beginning of our journey and so our focus is on purely organic growth within this market.

GBV: Could you describe how a corporate client would interact with Thomsons Online Benefits, in a concrete way, for our readers in HR who may not be familiar with dealing with a software provider?

CB: Typically, when talking to an organization, we find that there are one or several challenges they face, and they are often around the need to automate the administration; thus, they recognize they have manual processes entailing a great deal of risk for their benefits being managed and other associated downsides. Secondly, there is often a need for companies to better manage their risk management procedures as they are concerned that their processes aren’t standardized, with incredibly sensitive data being handled manually rather than being automated, particularly U.S. organizations won’t tolerate a lack of control on employee data. Thirdly, cost control is a major factor where companies often spend huge amounts, perhaps hundreds of millions of dollars on their benefits.And lastly, engagement, where companies spend huge amounts of money on their benefits programs and get little in return, with employees often not understanding what they get, or not valuing it accordingly.

These four challenges: Automation, Risk Management, Cost Control and Employee Engagement are the basics of any conversation with a potential client. We will simply work with the company to build a business case to understand why, and how, Darwin could help them solve some or all of these and more, challenges.

Often organizations are undergoing other changes at the same time and ultimately they need the technology to assist with those changes as well.

Thomsons works through partners and a direct market sales team so that if an organization is looking for a technology solution, they will work with us directly; or if it is technology coupled with administration services, then we will work with one of our partners (employee benefits consultancies or others) to deliver the services required, as opposed to other technology companies.

GBV: Do you have activities at the global level, and if so, how are they coordinated with your different local presences, if at all?

CB: Thomsons is headquartered in London and 60% of our 480 employees are based there with the remainder are in the U.S. (San Francisco), in Cluj in Romania, and in Singapore.

The U.S. and Singapore are mainly customer facing offices, while Cluj is technology development center of our organization.

GBV: Can you give us an outline of the competitive landscape?

CB: One of the challenges is that we have no direct competitors in this space, with nobody else having a similar product with a true global reach (one competitor has a similar product, but with less functionality), which makes building growth and momentum in the market hard to implement.

GBV: Are you worried about Xenefits announced entry into your market, especially with all the hiring from amongst others, Mercer?

CB: While we take all competition seriously, we are not too concerned. The U.S. benefits market is totally different from the global benefits market and over the years, many U.S. companies have tried to develop a global benefits solution, however, there has yet to be a successful one, given that U.S. benefits work in a completely different way.

Moreover, they’re very focused on the SME market, unlike our clients, who are typically the larger global organizations.

GBV: Can you give us some numbers?

CB: We have $50M of software revenue and have fully transitioned to a SaaS subscription model, based around Darwin.

In our experience we see U.S. companies generally buying our services for their global operations with a preference for global control and global technology, whereas mainland European companies do so to a lesser extent, and tend to operate more of a confederate model.

GBV: What kind of underlying technologies do you use? Any plans to change your existing technologies going forward?

CB: Darwin is very integrated into the core HTCM solution and then we typically provide a data feed to the in-country payroll with further integration at various levels, with different providers in different markets.

For example, ADP are one of our partners and have set up a new business division, ADP Global Benefits. The software that sits within their offering is Darwin and is fully integrated into their payroll software. Thus, in addition to the agency and direct sales, we also have an OEM sales channel with a number of organizations with two new significant partnerships we are entering into this month. Both organizations are very well known globally, and it’s a validation of our model that they are investing seven figure sums to develop the infrastructure in the global benefits market as they also see the growth in it.

Darwin is all developed in Microsoft technologies, mainly .Net, and we have a new release which goes across to all our clients every four weeks – across the board all at the same time. Moreover, we host everything in one data center, and the software has a three-tier structure, with a presentation layer, an application layer and a database layer, which makes it much easier and safer to introduce new features, new hardware platforms and new software standards.

Our single code line, all clients having the same software, regular updates and cloud based solution is, in our view, the optimal offering because of the evolutionary nature, rather than it being revolutionary in nature.

GBV: Can you describe a typical “from-scratch” client implementation process?

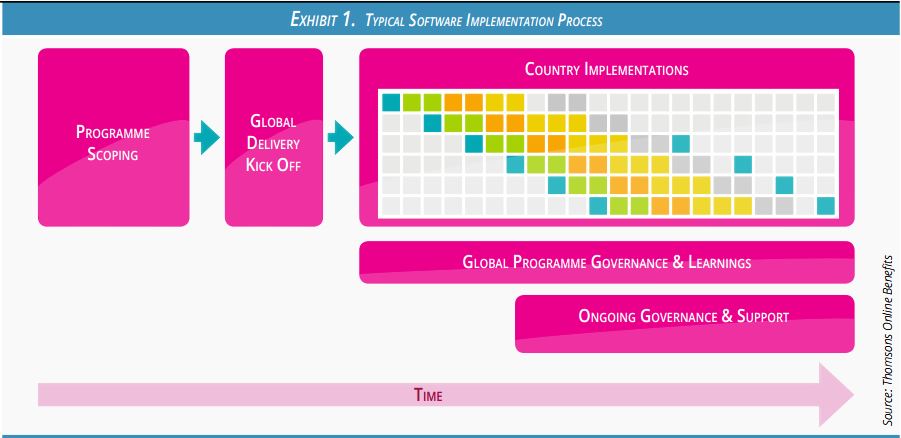

CB: Once a client has decided to sign up with us for our services and wants to use Darwin, we proceed with a global “kick-off” which effectively designs the parameters of how the client wants to work with us.

This is followed by implementation in countries, in parallel, typically a 3 to 6-month process with multiple countries running simultaneously. In our experience the speed of working with clients increases as a working relationship is built, and towards the end of the project we would typically reduce this figure to a three-month implementation period.

GBV: Do you have any thought-leadership or lobbying or influencing type of activities, and could you describe them?

CB: We did some research in 2014 on looking to evidence the link between Total Reward and Engagement & Benefits. Thomsons funded the London School of Economics for the research by Professor Sandy Pepper, which is featured in the “From the Lab to the Trenches” section of the March 2016 issue of Global Benefits Vision magazine.

We are also active on the thought leadership front as we actively aim to create a better understanding of this market and the challenges global benefits face and the need for global benefits software.

We also produce an annual ‘Global Employee Benefits Watch’. This report provides an insight into the HR industry’s pain points, uncovering the trends and advances enterprises have made in implementing global rewards strategies. It’s incredibly comprehensive, reflecting the opinions of global HR and benefits professionals across North America, EMEA and APAC.

With the niche nature of the global benefits market, many clients have also been forthcoming in discussing needs and opportunities in forums and reasons for working with Thomsons – which assists in influencing on both sides.

GBV: Could you give us a few recent examples of Thomsons Online Benefits activities that resulted in changes in legislation, regulations, attitudes, opinions, etc.?

CB: We do some lobbying, especially in the U.K. where we are in a dominant position, however, less so globally.

The big challenge nowadays is the discussion around data privacy laws which are very opaque, and there is a great lack of clarity around different countries and how they operate. That is an area, which I hope, governments will work together to clarify and simplify. However, it’s not a priority at the moment for us as most companies have already formed a view on this issue based on other software they use, however, certain things still need to be addressed.

GBV: What can you tell us about your plans as Thomsons Online Benefits’ leader for the next two years?

CB: We’re highly focused on executing our know how, through our software. We know exactly what we are doing and where we are going, following a proven plan and business model: selling directly to markets, but also assisting clients in building their business units to maximize their global benefits offerings, all powered by Darwin.

With our team of approximately 170 software developers, a third of our workforce and an area in which we have invested a great deal over the last three years, the software is moving at an incredible pace. Especially exciting is the area of predictive analytics and the way users are expected to interact with the HR tools they are given, similar to the way they interact with their consumer tools.

In the future we would look to grow our software, and company, organically rather than acquisitively.

Personally, my target over the next two years is to be out meeting people and talking about our product, so I will probably spend 75% of my time outside the U.K. in our global markets. As we don’t provide benefits software in the

U.S. but provide U.S. companies with a “rest of the world” solution, I will be spending a lot of time in the U.S. to offer and implement those ex-U.S. solutions.

GBV: Any final thoughts you’d like to share?

CB: The Global Benefits market is going through a transformation and companies are increasingly very aware of costs and the value they should be getting from their benefits schemes versus the spending on them. Global benefits leaders want to have the ability to know that benefits are being efficiently administered, properly communicated to employees, and invoices paid out to vendors are accurately calculated and affordable. Primarily, benefits leaders want to be able to have the information at their fingertips so that they know their strategy is effectively deployed across their organizations.

While global benefits leaders like what we do, often the hardest challenge is convincing the organization of its benefits – something that we are seeing being done more successfully nowadays. In this regard now is an exciting time as the global benefits market goes through this transformation.